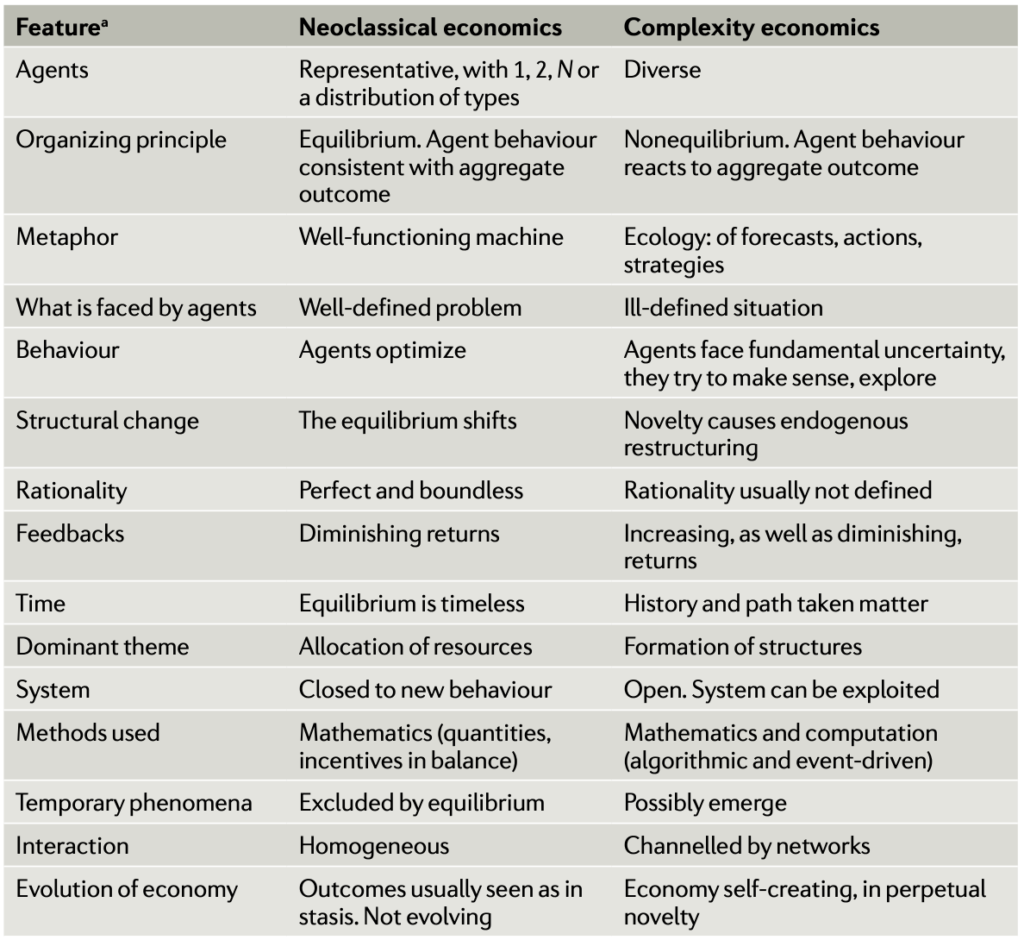

Arthur WB (2021) wrote a paper comparing conventional vs complexity economics.

Conventional neoclassical economics assumes:

- Perfect rationality. It assumes agents each solve a well-defined problem using perfectly rational logic to optimize their behaviour.

- Representative agents. It assumes, typically, that agents are the same as each other — they are ‘representative’ — and fall into one or a small number (or distribution) of representative types.

- Common knowledge. It assumes all agents have exact knowledge of these agent types, that other agents are perfectly rational and that they too share this common knowledge.

- Equilibrium. It assumes that the aggregate outcome is consistent with agent behaviour — it gives no incentive for agents to change their actions.

But over the past 120 years, economists such as Thorstein Veblen, Joseph Schumpeter, Friedrich Hayek, Joan Robinson, etc have objected to the equilibrium framework, each for their own reasons. All have thought a different economics was needed.

It was with this background in 1987 that the Santa Fe Institute convened a conference to bring together ten economic theorists and ten physical theorists to explore the economy as an evolving complex system.

Complexity economics sees the economy as not necessarily in equilibrium, its decision makers (or agents) as not superrational, the problems they face as not necessarily well-defined and the economy not as a perfectly humming machine but as an ever-changing ecology of beliefs, organizing principles and behaviours.

Complexity economics assumes that agents differ, that they have imperfect information about other agents and must, therefore, try to make sense of the situation they face. Agents explore, react and constantly change their actions and strategies in response to the outcome they mutually create. The resulting outcome may not be in equilibrium and may display patterns and emergent phenomena not visible to equilibrium analysis. The economy becomes something not given and existing but constantly forming from a developing set of actions, strategies and beliefs — something not mechanistic, static, timeless and perfect but organic, always creating itself, alive and full of messy vitality.

In a complex system, the actions taken by a player are channelled via a network of connections. Within the economy, networks arise in many ways, such as trading, information transmission, social influence or lending and borrowing. Several aspects of networks are interesting: how their structure of interaction or topology makes a difference; how markets self-organize within them; how risk is transmitted; how events propagate; how they influence power structures.

The topology of a network matters as to whether connectedness enhances its stability or not. Its density of connections matters, too. When a transmissible event happens somewhere in a sparsely connected network, the change will fairly soon die out for lack of onward transmission; if it happens in a densely connected network, the event will spread and continue to spread for long periods. So, if a network were to slowly increase in its degree of connection, the system will go from few, if any, consequences to many, even to consequences that do not die out. It will undergo a phase change. This property is a familiar hallmark of complexity.

Reference:

- Arthur, W.B. (2021). Foundations of complexity economics. Nat Rev Phys 3, 136–145 (2021). DOI: 10.1038/s42254-020-00273-3