I was invited to IEEE Fest 2025 as a representative of the IEEE Indonesia Section Advisory Board. The event was hosted by the IEEE Brawijaya University Student Branch in Malang on 18 October 2025, led by the Chair, Muhammad Asyir Zarkasih. The program was commenced by the Vice-Rector for Student Affairs and Entrepreneurship, Dr Setiawan Noerdajasakti, together with the university’s faculty and departmental leaders. It was particularly noteworthy to see IEEE SBUB expanding beyond its traditional STEM roots into areas such as management and law.

In my short welcoming remarks, I encouraged the strengthening of enthusiasm, commitment, and innovation capability through collaboration, making use of available channels while initiating the door for broader engagement across IEEE’s various organisational units and programs. In a landscape as complex as today’s, challenges are indeed easier to navigate together; but more than that, complex collaboration often reveals new opportunities, both in innovation and in business.

Prior to the event, in the holding room, we had a discussion with the Vice-Rector on reinforcing an innovation-driven entrepreneurial ecosystem that leverages Telkom Group’s digital platforms and connectivity, alongside the strong collaborative resources of IEEE, including IEEE Indonesia Section. Follow-up actions are now being prepared at both university and faculty levels.

I specifically requested that the founding generation of Workshop TEUB, i.e. several alumni from the E88 cohort, to be present as well. Workshop TEUB was established by a trio: Sigit Shalako Abdurajak, Widiyanto, and yours truly; together with the early activists who were deeply involved in innovation and training initiatives. Several of them were able to attend the event: Saiful Hidayat, Aries Boedi Setiawan, Moch Iszar, and others who unfortunately could not join.

We originally founded the Workshop to address significant limitations in academic content as well as the capability and capacity gaps within our alma mater at the time. To our surprise and pride, the next generations have carried the Workshop far beyond what we imagined. Now operating as an autonomous unit under HME, it has grown into a hub of innovation excellence. The current Head of the Workshop is Akmal Mulki Majid.

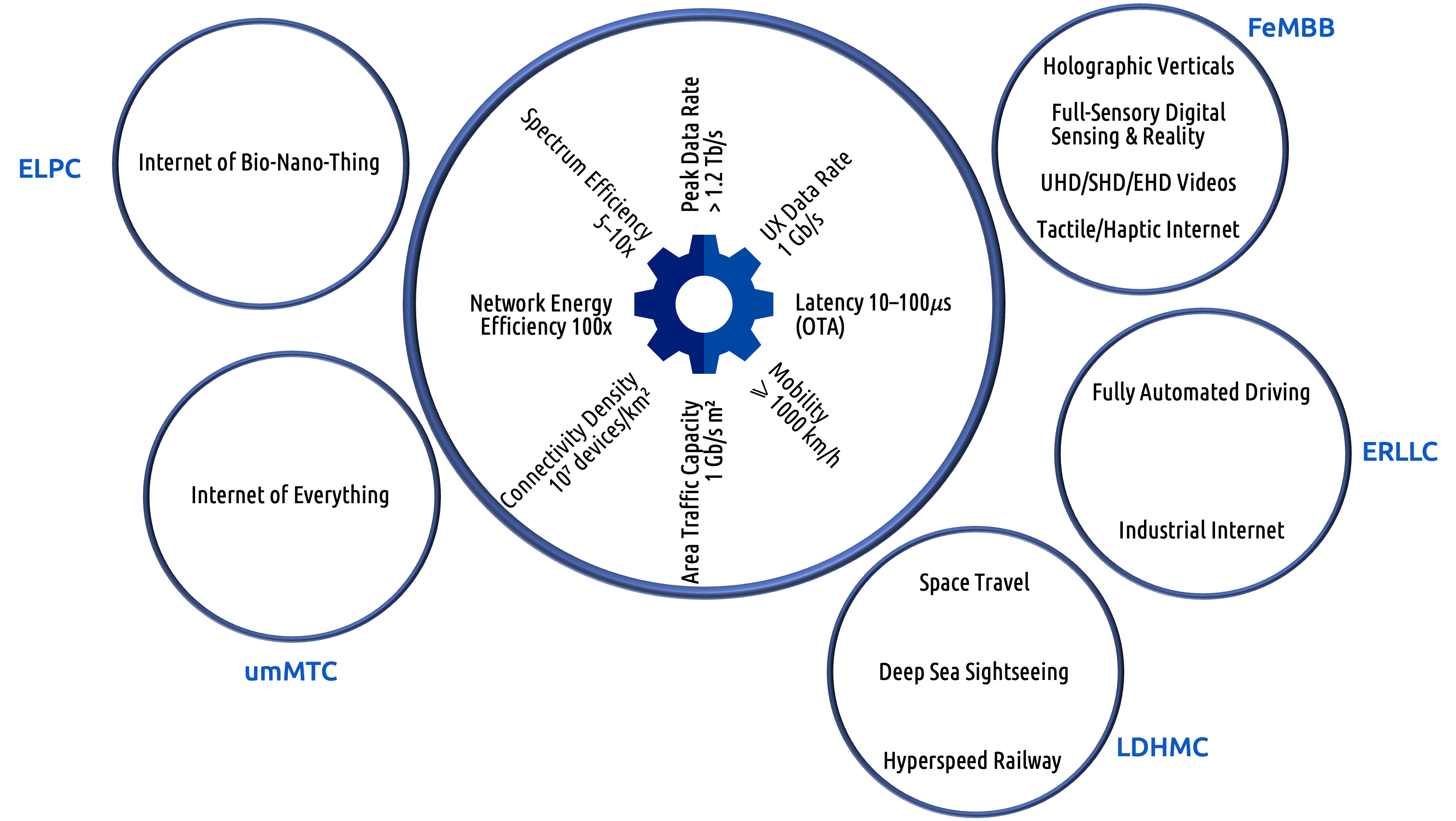

IEEE Fest 2025 also featured a student innovation exhibition, presented through a series of presentations and booths from units under HME and the Workshop, along with various other innovation teams across the university. Students showcased their leading work, including IoT implementations, robotics platforms, and their early integrations with intelligent systems. One highlight was Elektro Formula Brawijaya, an EV innovation bridging technological capability with real-world demands. These exhibitions showed that UB students are not merely following technological trends. They are confidently pushing past them, designing precise, concrete solutions ready for industrial validation.

Alongside the exhibition, we conducted a tour of the Workshop and the Electrical Engineering laboratories, accompanied among others by the HME Chair, M Iqbal Maulana. This included, of course, the Electronics Lab, where Sigit Shalako and I once served as lab assistants. The lab has since moved location and now operates with far more advanced, high-precision experimental modules.

The event itself lasted only a day, but the collaboration certainly will not stop there. Technical consultations, sociopreneurship initiatives, and new strategic partnership pathways will continue to grow, strengthening the innovation ecosystem and supporting the sustainable development of national talents.